Bayt Misr

Bayt Misr is an Egyptian PropTech joint stock company, established under the Jurisdiction law 159 year 1981, the first Mortgage Brokerage company in Egypt licensed from Financial Regulatory Authority (FRA), April 2022, to faciliate and automate mortgage financing online

Bayt Misr Services

Principle, vision and goals

Our principle is to build a standard of trust with our clients and provide our services professionally

Our vision is to be the leading platform in Egypt for providing real estate mortgage services

Our goal is to reshape and advance the real estate selling and purchasing of real estate through mortgage

Bayt Misr Services

Preparing the financing application and submitting it to the mortgage institution for credit approval

- Providing technical and financial consultation to the customers through specialized consultants

- Ensure that all the required documents are completed and reviewed

- Conducting the residence investigation check

- Conducting the workplace investigation check

- Releasing the i-score credit report

- Reviewing the customer’s credit balance and maximum financing allowed

- Preparing the financing application and submitting it to the mortgage institutions for approval

- Booking appointments at the financing institutions

- Following -up with the mortgage institutions and ensuring credit approval is obtained

Searching for properties applicable for mortgage, reviewing and obtaining legal approvals

- Searching for one or more properties applicable for mortgage and as per the specifications set ahead by the client

- Presenting properties including with all information and mortgage plan (Deposit and Monthly Installment)

- Setting up and Coordinating the schedule of visiting properties

- Providing technical and real estate consultations to the client through specialized consultants

- Communicate with the broker / owners of the porerties and obtaining the required legal documents

- Review the property legal documents and submitting it to the mortgage institution for legal approvals

- Drafting the contract between the buyer and the seller and coordinating the signing process

Following-up with the mortgage institution to finalize the financing procedures

- Follow-up with the credit department to finalize the required credit approvals

- Follow-up with legal department to finalize the property appraisal

- Follow-up with the legal department to finalize the legal approval

- Follow-up with the risk department to finalize the risk approval

- Follow-up with buyers and sellers to finalize the required POAs

- Follow-up with the mortgage institution to release the financing loan

- Setting up the schedule of the final mortgage signing agreement

- Ensure that all procedures are completed and the real estate unit is received

How do we work?

First: Dedicated professional team to communicate and handle customers through out all cycles. Three specialized teams:

Customer Service Team: Responsible for communicating with potential clients, responding to their inquiries, explaining the mortgage stages, handling agreements, and following-up on clients’ documents till completion.Mortgage Team: Responsible for reviewing the documents submitted, client’s credit doucments and property legal documents, communicating with the mortgage institutions and following-up with clients during all mortgage stages till mortgage signing is complete.

Property Consultants Team: Responsible for communicating with our partners from real estate brokerage companies to locate the appropriate and applicable properties for clients and coordinate visits and obtain the required legal documents.

Second: Automated Communication and notification through:

BaytMisr.com: Online Platform and Applications where mortgage request form is submitted online.Social Media Platforms: Fill in the mortgage request form through links on our pages on all social media platforms Facebook & WhatsApp

Automated Notifications: Automated Notifications sent automatically on all mortgage stages updates.

Third: Follow -up during the mortgage stages

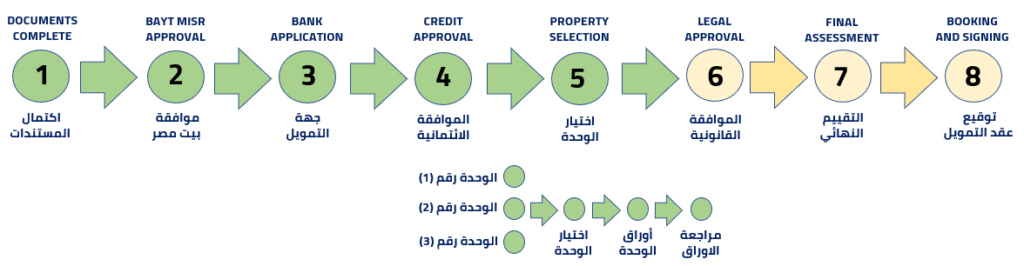

- Mortgage Request Form: submitting the basic information of the client financials and the revision from Bayt Misr mortgage team

- Initial Credit Approval: The approval of granting mortgage financing from a mortgage financing institution, provided that the documents are completed

- Documents Completion: Review the required credit documents and completing the procedures for i-score, residence and work invetigations

- Bayt Misr Consent: Approval of Bayt Misr for the client’s credit documents

- Mortgage Application: Submit the financing application to +3 mortgage institutions

- Credit Approval: Follow-up with the mortgage institutions till credit approval is granted

- Selection of the Property: Searching for (3) suitable and applicable for mortgage properties, coordinating the dates of the visit, and obtaining the legal documents required

- Legal Approval: Reviewing the Property legal documents and submitting to the mortgage institution and follow-up until legal approval is granted

- The agreement contract: signing the primary agreement contract with the owner of the unit, reserving the unit, and paying a deposit

- Final Assessment: Follow-up with the mortgage institution to finalize client’s investigations and property appraisal

- Mortgage Booking: Follow-up with credit department and all parties (seller and buyer) till final contract is signed

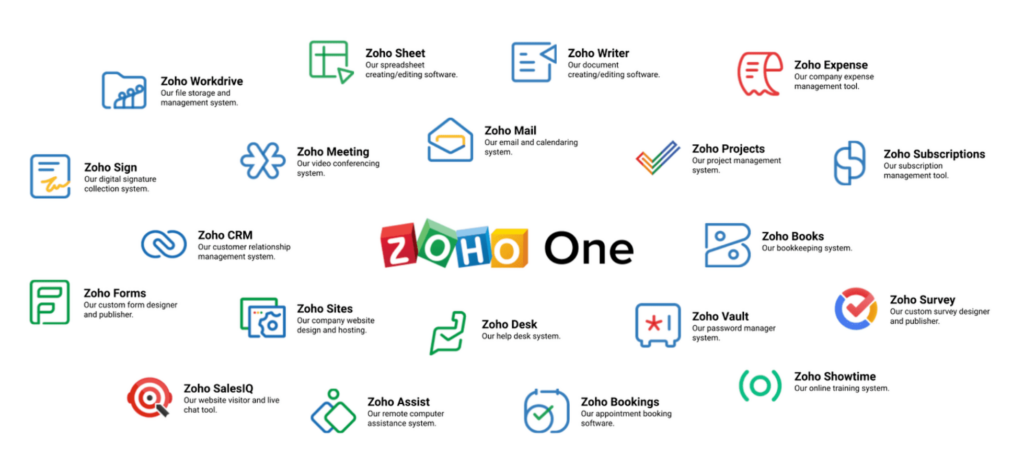

Fourth: Depolyment state of the art zoho one ERP system to efficiently manage clients' journey through out all mortgage stages

Bayt Misr is thrilled to announce our participation in Flat 6 Labs cohort program no. 19. Flat 6 Labs is a leading startup accelerator and seed stage investment company in the Middle East and North Africa region. This prestigious program selects only the most innovative and promising startups, and we are proud to have been one of six companies chosen out of a pool of 800 applicants. Flat 6 Labs has been an invaluable partner in helping us grow and develop our business, and we are grateful for the support they have provided us thus far. Currently, Flat 6 Labs is investing in Bayt Misr, and we are excited to continue working with them to achieve our goals and make a meaningful impact in our industry.

Executive Management

Tarek Elghamrawy, Chairman and CEO of Bayt Misr

, extends for more than 20 years in the real estate industry, during which he held many leadership positions in major real estate development companies in Egypt and abroad, including GM of ALDAU Real Estate Development Sami Saad, Head of Real Estate Portfolio Sector at Palm Hills Development, in addition to holding the position of Director of Middle East Projects for SOM International, and Director of Infrastructure Sector for Parsons Brinkerhoff WSP Consulting, Qatar. Dr. Elghamrawy holds a Ph.D. in Project Management from the University of Illinois, Urbana-Champaign, USA and a M.Phil in Infrastructure Management from Japan.

Tarek Elghamrawy, Chairman and CEO of Bayt Misr

, extends for more than 20 years in the real estate industry, during which he held many leadership positions in major real estate development companies in Egypt and abroad, including GM of ALDAU Real Estate Development Sami Saad, Head of Real Estate Portfolio Sector at Palm Hills Development, in addition to holding the position of Director of Middle East Projects for SOM International, and Director of Infrastructure Sector for Parsons Brinkerhoff WSP Consulting, Qatar. Dr. Elghamrawy holds a Ph.D. in Project Management from the University of Illinois, Urbana-Champaign, USA and a M.Phil in Infrastructure Management from Japan.  , extends more than 15 years in the information technology, programming, and data engineering sector. He is currently working as a Senior Engineer for Artificial Intelligence and Data Programming at Spotify, the world’s largest digital music streaming platform. Eng. Mansour brings together many distinguished experiences in the field of programming and virtual reality during his work as a software engineer in many Egyptian and international companies. Eng. Mansour has received many local and international awards, the most important of which is the United Nations honor for world heritage conservation projects.

, extends more than 15 years in the information technology, programming, and data engineering sector. He is currently working as a Senior Engineer for Artificial Intelligence and Data Programming at Spotify, the world’s largest digital music streaming platform. Eng. Mansour brings together many distinguished experiences in the field of programming and virtual reality during his work as a software engineer in many Egyptian and international companies. Eng. Mansour has received many local and international awards, the most important of which is the United Nations honor for world heritage conservation projects.